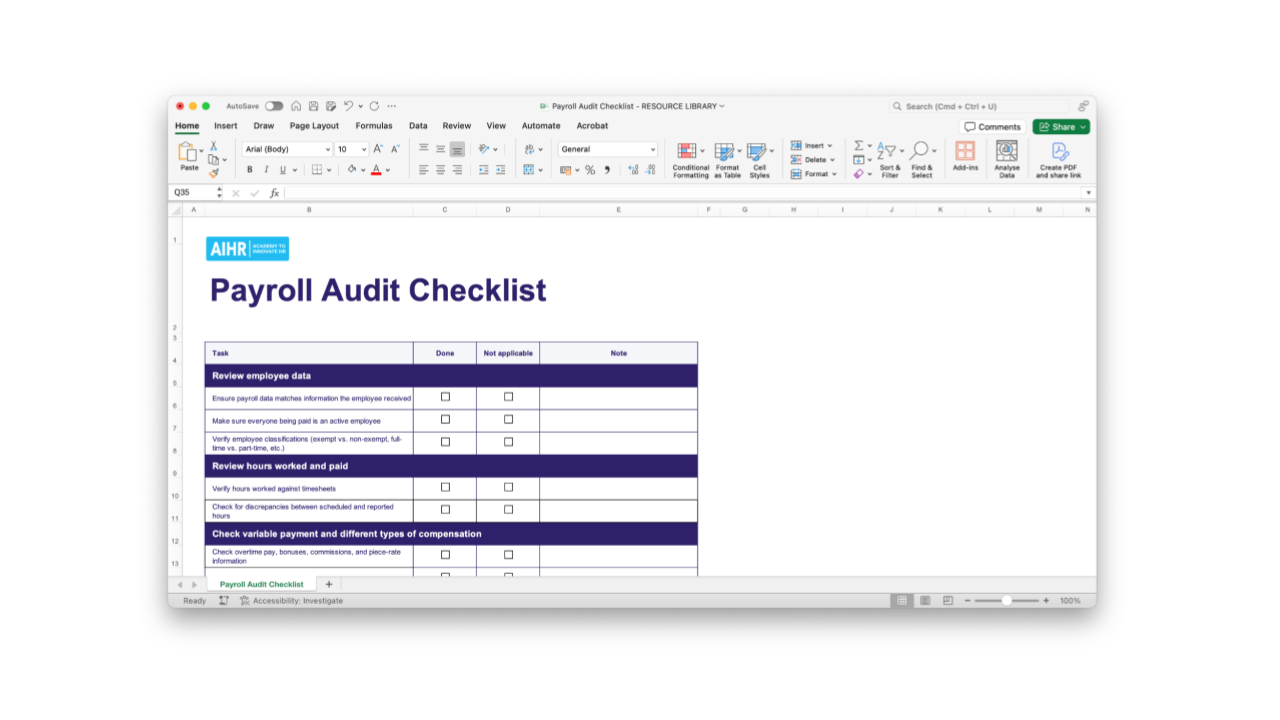

This payroll audit checklist provides a comprehensive guide to reviewing and improving payroll processes. Covering everything from employee data to tax withholdings, it helps HR and payroll professionals ensure accuracy, compliance, and operational efficiency.

Included in this resource:

- Employee data

- Hours worked and paid

- Variable payment and different types of compensation

- Atypical payroll transactions

- Tax withholdings and deposits

- Reconciling payroll

- Payroll rules

- Reporting the findings

- Improvement opportunities

- Implementing improvements